Consumer Guide to Credit Reporting

Understand How Credit Bureaus Measure Your Financial Well-Being

First, let's review the basics.

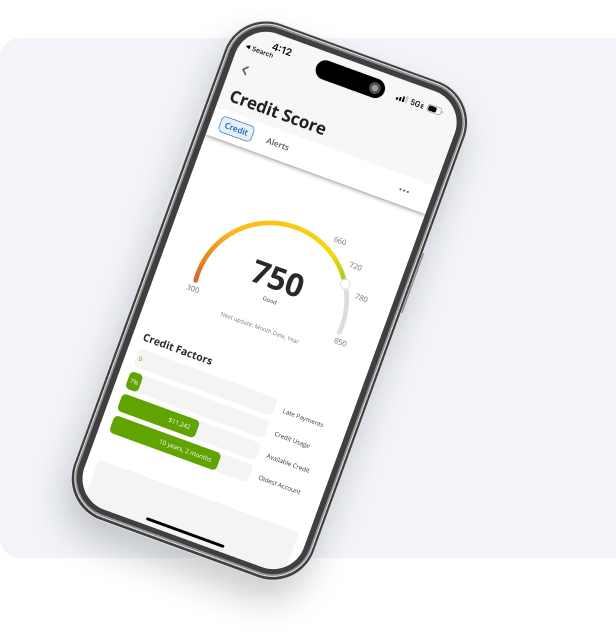

Credit Score

A credit score is a single number that represents your financial wellness.

Credit Bureau

Three major credit bureaus, Equifax, Experian, and TransUnion manage your credit report(s) and calculate your scores.

Credit Report

A credit report lists a history of your personal and financial information which is used when calculating your credit score.

Where do credit bureaus get their information?

The account information on your credit report can be provided to the bureaus by creditors. Creditors can be your bank, credit card issuer, loan company, and even a collection agency or debt buyer. They may report their information to all major credit bureaus or to only some. For more information on Resurgent's Credit Reporting Policy, please visit our FAQs.

Who uses credit scores?

Interested in a credit card, loan, apartment, home, or even a new job? In some cases, these types of institutions will take your credit score into account during their decision-making.

Why does this matter?

A credit score exists as an indicator of your financial wellness. While a credit score reflects past financial choices and decisions, it is used as a forward-looking tool to evaluate how timely and consistently you will make payments. Therefore, it is important to understand the impact your current financial choices can have on building credit for your financial future. A good primer on credit scores is available free from myfico.

What makes up a credit score?

If you understand how a credit score is calculated, it's easier to build or repair your credit. There is no standard calculation for credit scores, so the three major credit bureaus, Equifax, TransUnion, and Experian may all have differing scores for the same individual. Another reason they provide different scores is that not all creditors report to all three major credit bureaus. While there is no concrete guide to building or repairing credit, the following things typically impact most individual's scores:

- • The number of accounts you have opened

- •Available credit and balances

- •Whether you make payments on time

- •Whether any accounts are past due

How can I see my credit report?

By law, each credit bureau is required to provide you with one free credit report yearly. You can also access these reports through AnnualCreditReport.com. When you look at your credit report, you may be able to identify the factors that are negatively affecting your score. For now, here are the most common ways that may make a positive impact on your score:

- • Making payments on time

- • Paying off old debts

- • Using less credit than you have available

- • Applying for new credit less often

- • Keeping your oldest accounts open